Studying the market: Why purpose-built student accommodation adds up for smart investors

by Lois Jones

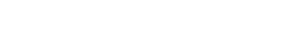

Increasing numbers of international students are looking to Europe to continue their education, making up a more sizeable portion of the student demographics in many European countries. This trend has not only been seen and acted upon in Germany, which at the same time has experienced a decrease in domestic student numbers, but across the continent, with Turkey, France, Spain and Italy each offering more than 1,000 English-taught courses at its universities, as Figure 1 shows.

While Germany’s opposing trends in student populations (nearly 4% international population growth between 2017 and 2022 compared to a slight decrease in domestic population growth) paints the most extreme picture, modest domestic student growth paired with a much higher international student growth percentage is commonly seen in other countries. This international student growth story is boosting university numbers, particularly at the higher-ranked institutions, and putting greater strain on an already-undersupplied student housing market in many locations. The provision rate in the likes of Germany, Italy and Spain for purpose-built student accommodation (PBSA) is well below 10%.

Where should students live?

Antonio Marin-Bataller

There is one major problem, however. Where should these growing ranks of students live, given the current undersupply of suitable student accommodation? This is a question with less obvious answers but helpfully contextualised by looking at specific markets. Let’s look at Italy. The country has experienced rapid growth in the numbers of its domestic students, who are relocating to cities away from home, particularly to the north of Italy, where the main, most prestigious universities and politecnicos (technical universities) are located. Adding to the problem, students in Italy often study for five years, rather than three years as is common in the UK for example, says Antonio Marin-Bataller – PATRIZIA’s Head of Investment Management Living. Moreover, Italy is welcoming a growing cohort of international students, one reason for this being that the country is a top location for Erasmus students (those students who benefit from the Erasmus+ Programme which facilitates study abroad) and USA StudyAbroad students (broadly the US equivalent of Erasmus).

Learning about students‘ needs

Providing such suitable accommodation is the next problem. Gone are the days when a student would be content with a dormitory room equipped with a single bed and a desk. Today’s modern student seeks accommodation with added amenities, whether a shared communal kitchen and lounge, or access to a gym. In other words, dedicated areas for his or her studying, socialising, exercising and relaxing. Many students even look forward to tailored activity programmes, designed to support their wellbeing, encourage friendships and help with their studies. However, older student accommodation is often dated and fails to meet these evolving demands.

As a consequence, the demand for high-quality purpose-built student accommodation (PBSA) is becoming more and more essential throughout the European real estate market. Combined with the need to improve the available accommodation, is the dual – and contradictory – need to make such housing affordable. Already, many students are being priced out of the market. At the same time, buildings need to adhere to the latest ESG standards to attract real estate investors.

“In Italy, we have a low provision of student housing so the supply is not there to satisfy that demand. And the available accommodation is not fit to meet modern student needs. Therefore, we see a strong opportunity to develop a more Anglo-Saxon type accommodation, with sought-after modern amenities, such as communal study areas.”

PATRIZIA’s strategy towards unlocking this conundrum

In response to this dilemma, PATRIZIA is introducing a pan-European living value-add strategy, which aims to create a portfolio of student assets across several European cities. The countries in focus include the UK, Germany and Italy.

“We are in discussion with developers to create joint ventures with best-in-class portfolios,” Antonio says. “Student housing plays an important role in this value-add strategy.”

Already, PATRIZIA owns roughly 5,000 student units, spread across several European countries. Most recently, in the last few years, PATRIZIA invested EUR 550 million into creating a portfolio of 2,800 PBSA beds in Denmark, Ireland, Italy and Spain.

KEY STAT: The provision rate in the likes of Germany, Italy and Spain for purpose-built student accommodation (PBSA) is well below 10%.

Als hilfreich erweist sich außerdem, dass die Nachhaltigkeitsstrategie des Investmentspezialisten bereits auf das Pariser Klimaabkommen und die UN-Nachhaltigkeitsziele abgestimmt ist. Pugh meint: „Klimaabkommen und Nachhaltigkeitsziele gehen in dieselbe Richtung, nämlich bis 2050 CO2-Neutralität zu erreichen. Diese Ambition bildet auch die Grundlage unserer internen Strategie. All die Vorschriften, durch die nun Bewegung in den Markt kommt, entsprechen bereits unserer Selbstverpflichtung, bis 2040 die Netto-Null zu erreichen. Damit sind wir den rechtlich verbindlichen Zusagen aller Länder, in denen wir aktiv sind, voraus. Unsere Strategie erfüllt bereits, was Gesetzgebungen weltweit derzeit zu erreichen versuchen.“

In recent years, Barcelona’s local authority has chosen to largely limit student housing development to the outskirts of Barcelona. “This kind of asset, located in the heart of Barcelona, is very rarely available so has proved to be a strategic positioning for us,” Antonio shares. Over the past two years, PATRIZIA was already able to push up the asset’s rents by over 30% from the level set by the previous owner, as well as increase annual occupancy from 81% to 93%.

Turin investment ‘exceptionally compelling’

Meanwhile in Italy, PATRIZIA invested EUR 70 million in the forward purchase of a PBSA scheme in Turin. The student development lies on Via Fréjus to the west of the city centre between the city’s prestigious Politecnico di Torino which has 33,000 students and the University of Turin with its 81,000 students. The student development boasts 582 en-suite studio bedrooms and various amenities, including communal kitchens, a gym and study areas. Turin is home to Italy’s fourth-largest student population with more than 100,000 full-time students. However, the city suffers from a severe lack of student accommodation, with just one bed for every 16 students which equates to a PBSA provision rate of just 6.5%. As a result, the development is ‘an exceptionally compelling investment opportunity for our global client base’, according to Antonio.

PBSA market is thriving

Overall, the PBSA market is proving to be vibrant, with the promise of great potential for the future, particularly considering the rapidly growing demand from students at home and abroad and a chronic undersupply of suitable, affordable student housing in city centres. Moreover, in many European countries, PBSA falls outside residential regulations, meaning that investors can increase rents closer to market levels. Other factors, including a high churn rate, a supply/demand imbalance and high yields, all add up to make PBSA a sound investment.

As Antonio concludes succinctly: “PBSA is an attractive and key part of PATRIZIA’s living sector strategy.”